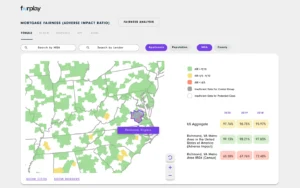

Fair Lending Analysis

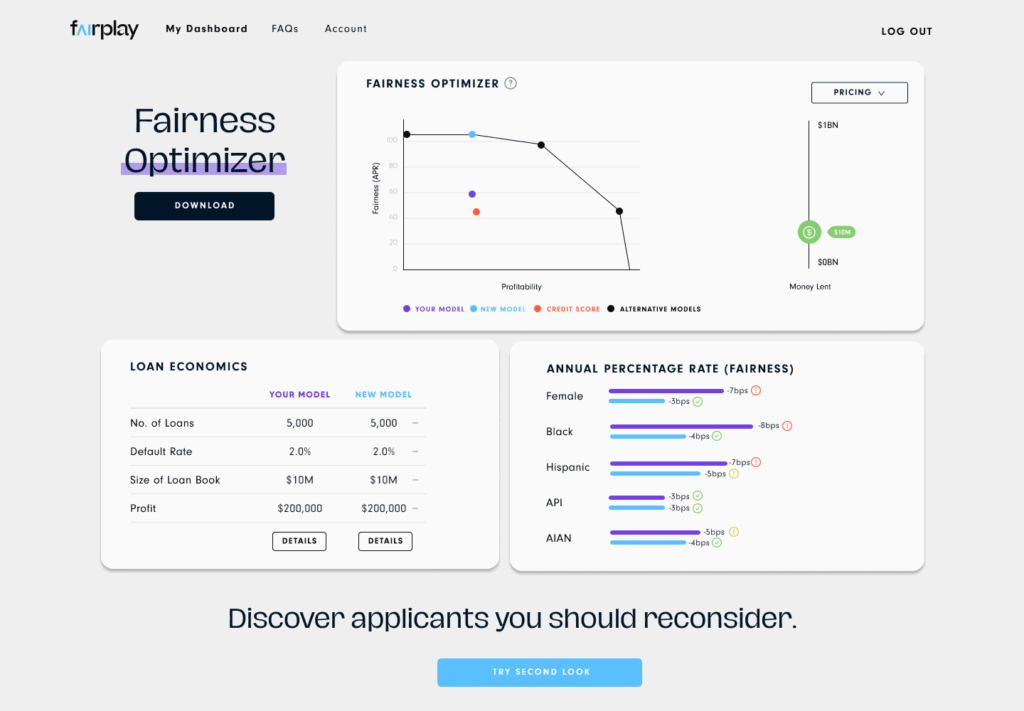

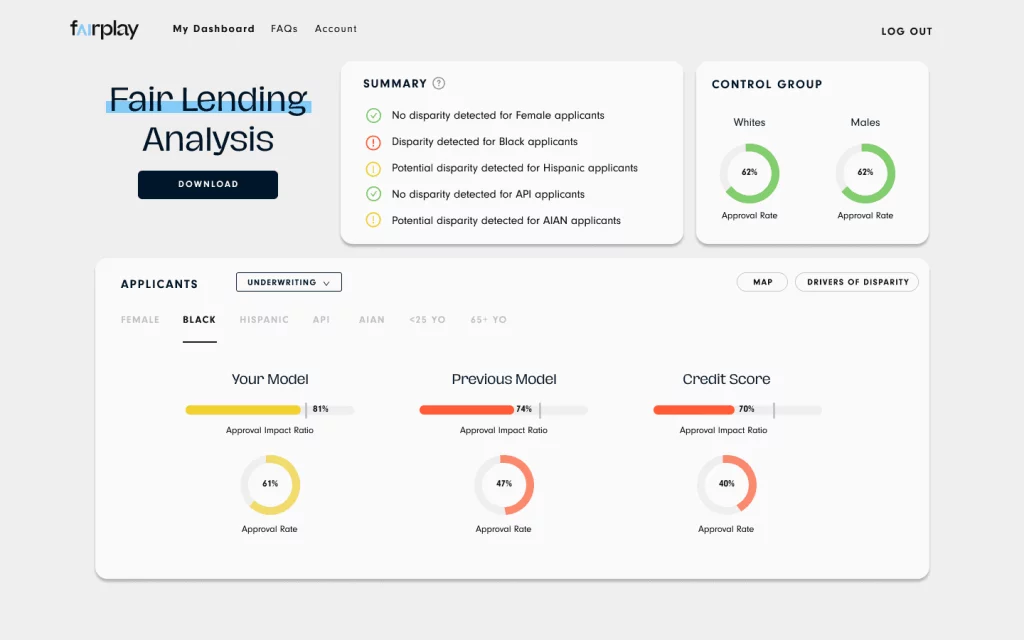

Identify and overcome tradeoffs between performance and disparity.

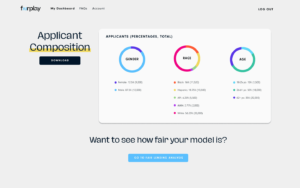

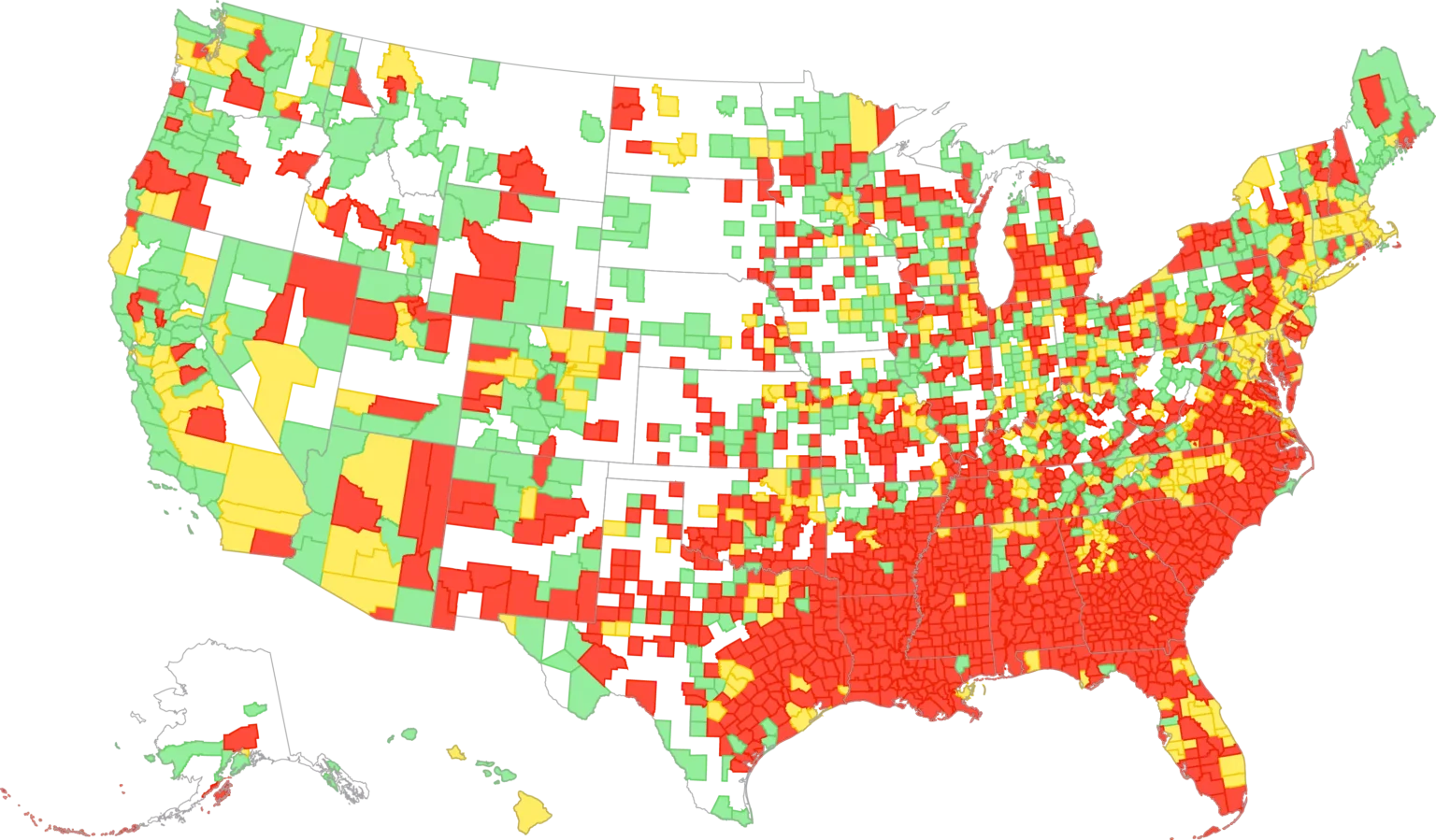

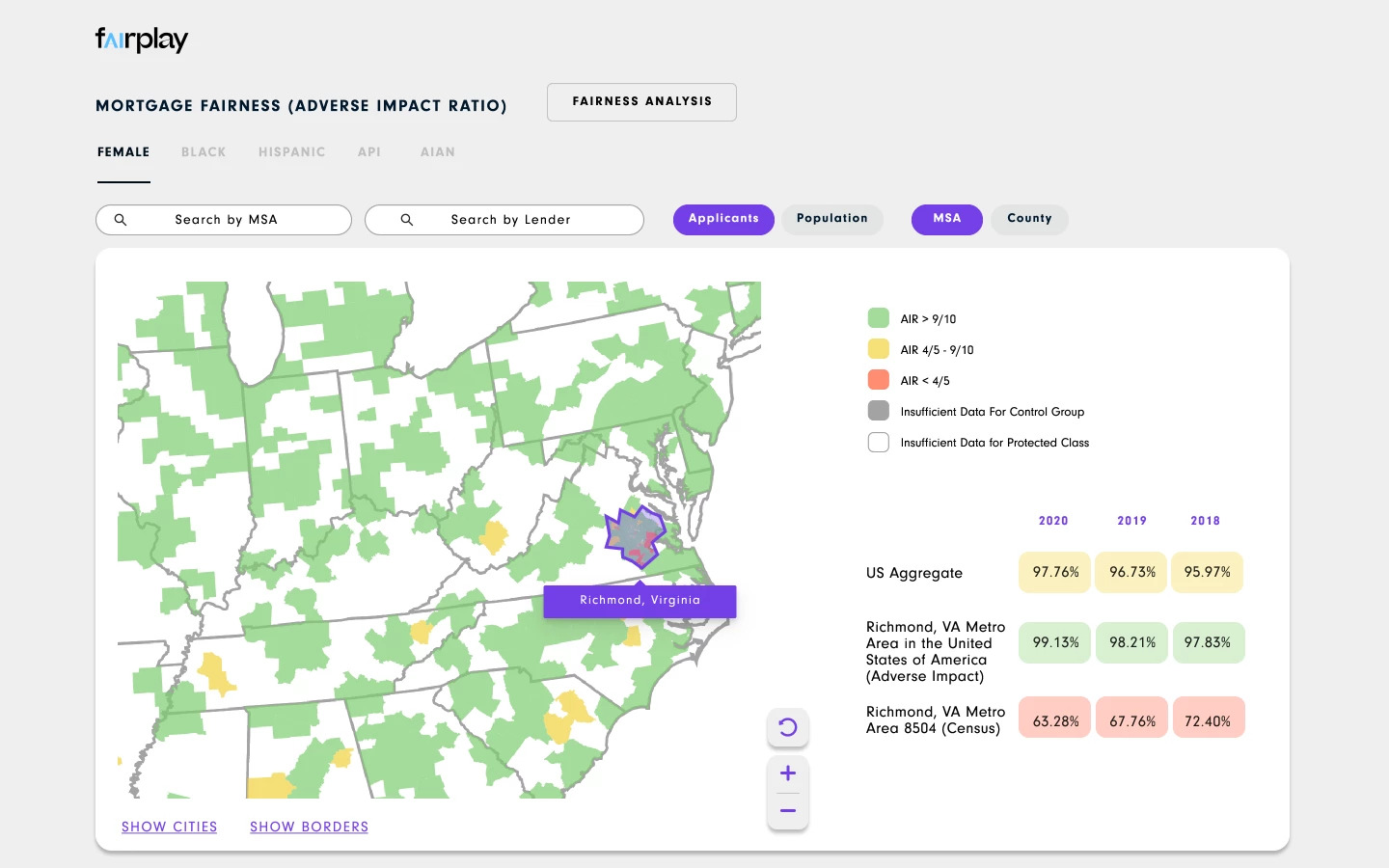

Your AI models power lending, credit risk, and fraud detection. But hidden bias and compliance pitfalls can expose you to regulatory scrutiny and time-consuming manual reviews. FairPlay automates AI governance, cutting validation times by up to 80% while keeping your models profitable, fair and auditable. See customers and seize opportunities others don't. Stay ahead of shifting regulations. Protect your reputation. Scale AI decisions with confidence.

Banks, credit unions, fintechs, and specialty lenders choose FairPlay to make better AI decisions. FairPlay analyzes 300+ million AI-driven decisions monthly, delivering compliance faster and more reliably for:

Transparent, defensible AI decisions

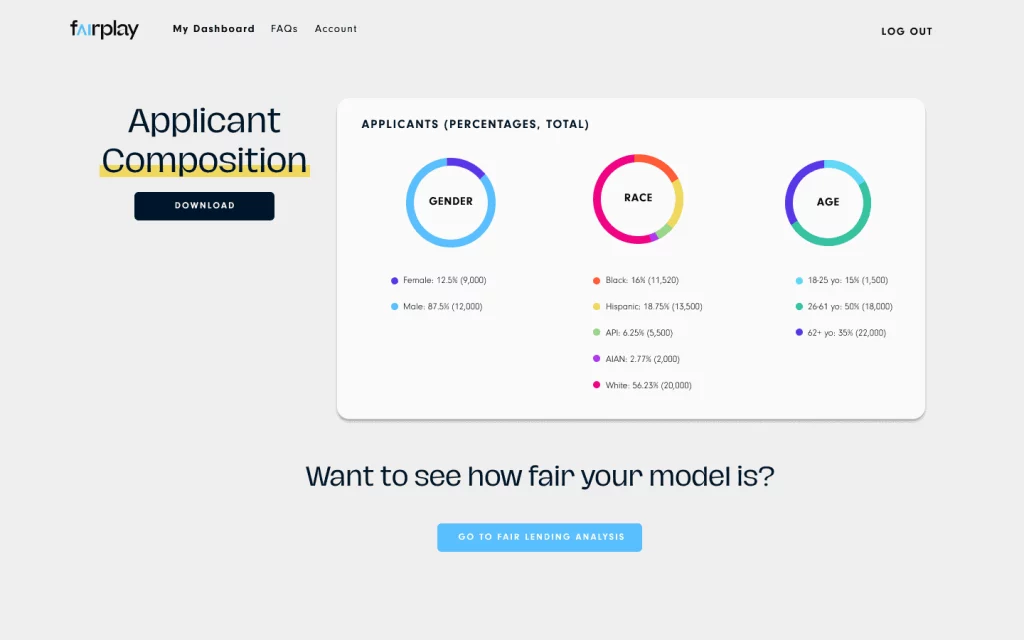

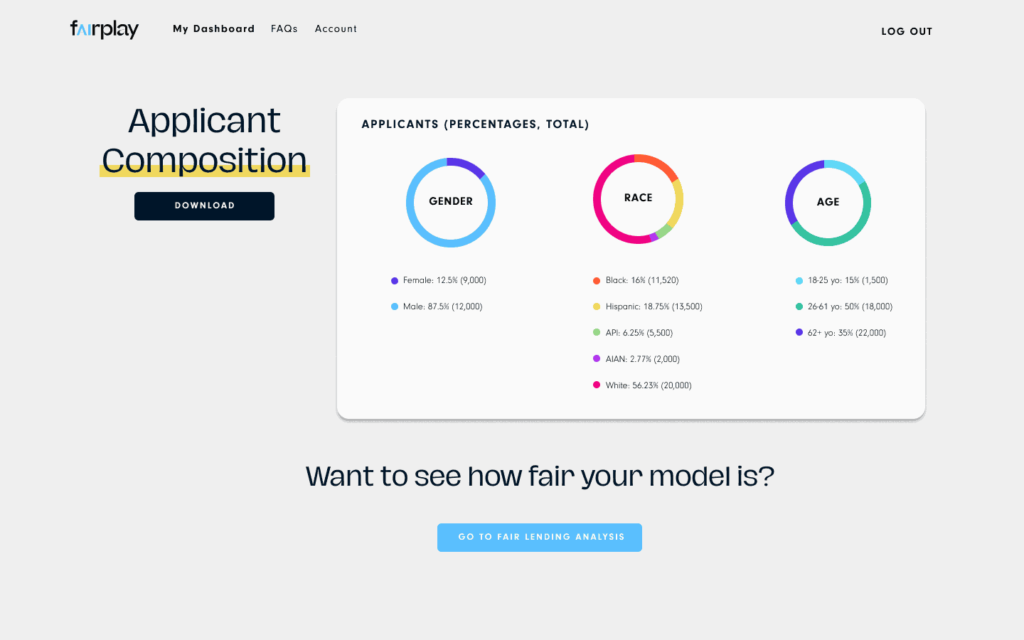

Real-time performance and fairness oversight

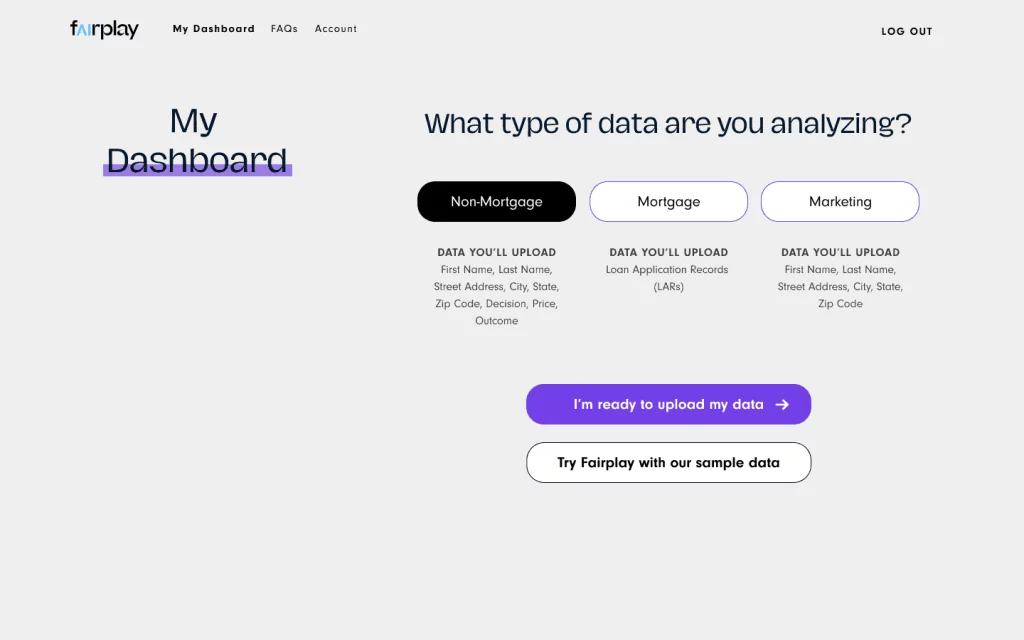

Unify internal and vendor model validations

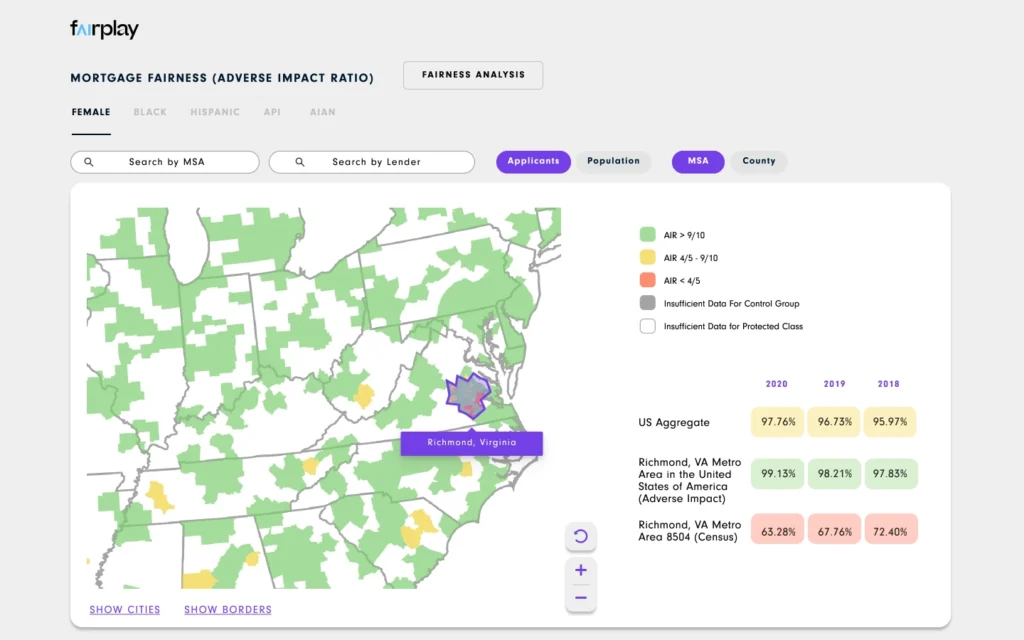

Expand lending without regulatory blowback

“Now we can treat compliance the same way we treat credit underwriting, tweaking the model, running the model, analyzing the data, and continuing to make changes.”

Manual audits and frantic data hunts don’t just waste time—they create compliance risk. FairPlay gives you continuous compliance oversight and on-demand regulatory reporting.

Manual, annual audits

Continuous, real-time oversight

Weeks of gathering data for regulatory review

On-demand compliance reports — no last-minute scrambling

Lengthy, fragmented model validation

Independent reviews of internal and third-party AI systems

Surprises leading to lawsuits and enforcement actions

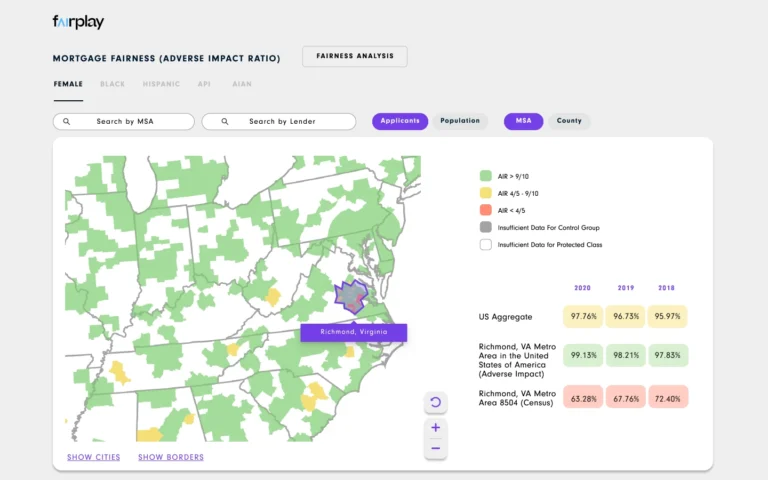

Instant alerts for bias and governance gaps - fix issues early

FairPlay delivers tangible benefits across your organization—from shorter review cycles to bigger returns.

Request demoAutomate model audits, free up your teams

Detect bias early, safeguard your bottom line

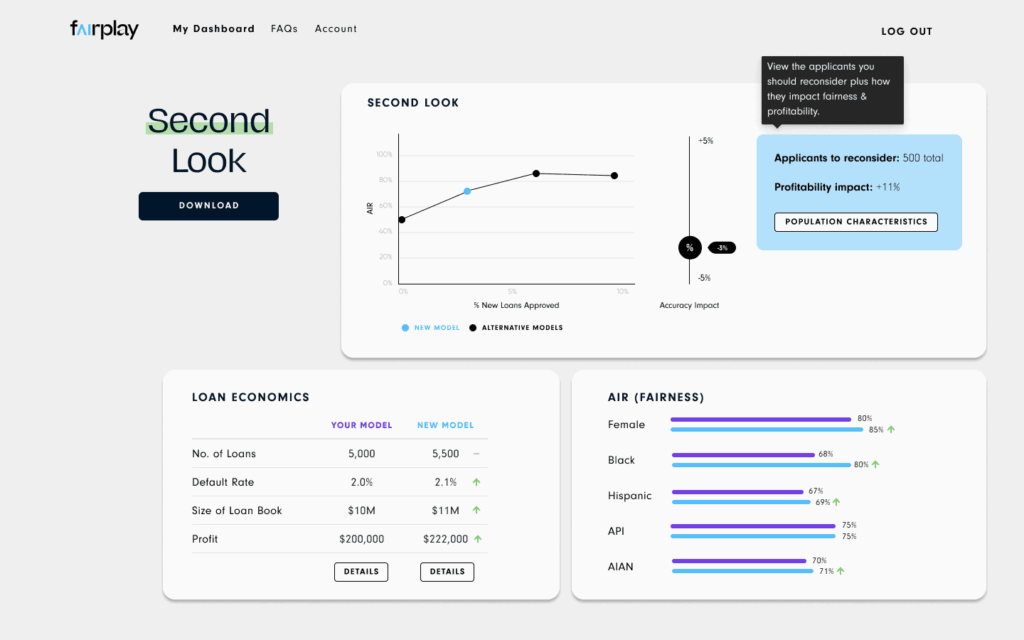

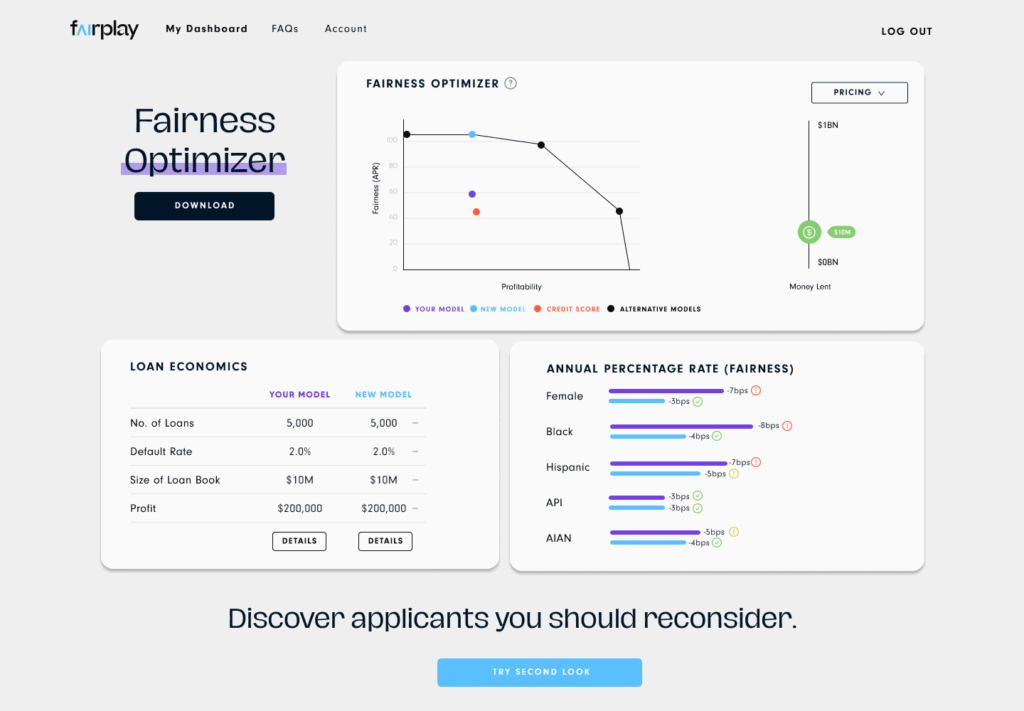

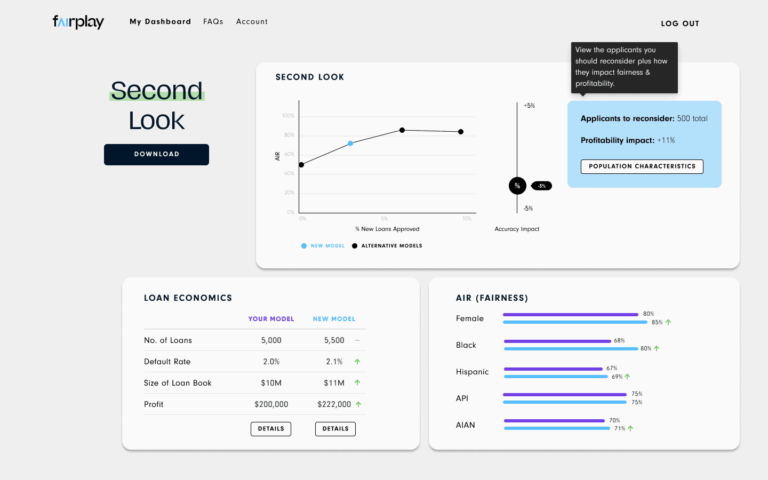

Optimize for performance and inclusion

Satisfy OCC, CFPB, FDIC, and state analytics and documentation standards

Don’t let hidden risks slow you down. FairPlay AI keeps you one step ahead of new regulations—and your competition.

Explore our collection of podcasts, research, and expert insights on building more equitable financial systems through responsible AI