Fair Lending Analysis

Identify and overcome tradeoffs between performance and disparity.

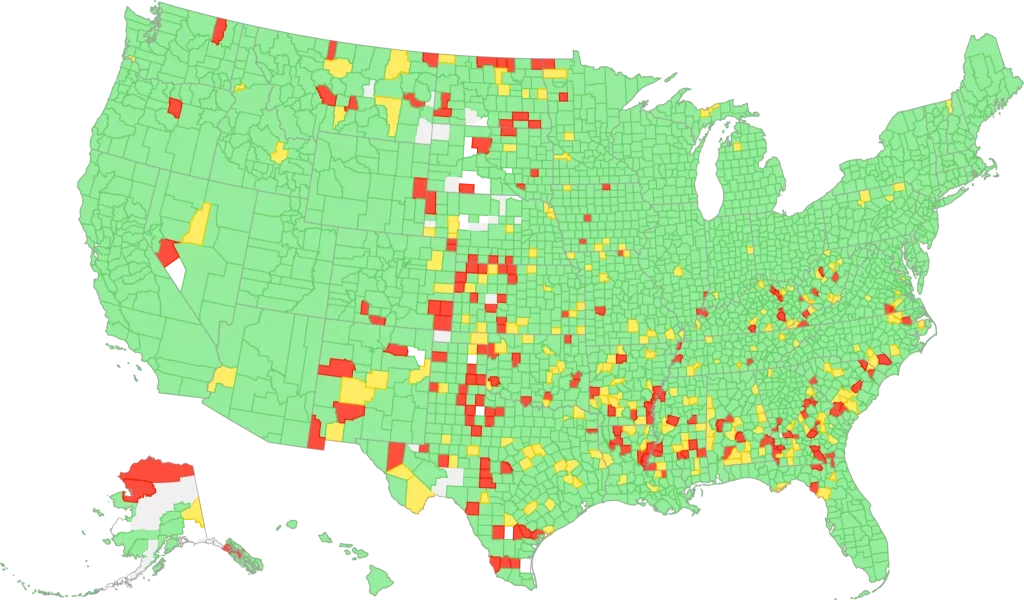

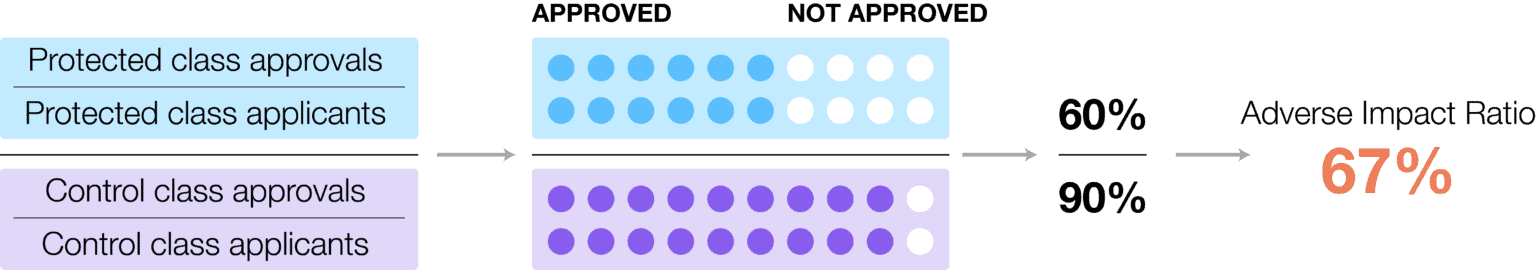

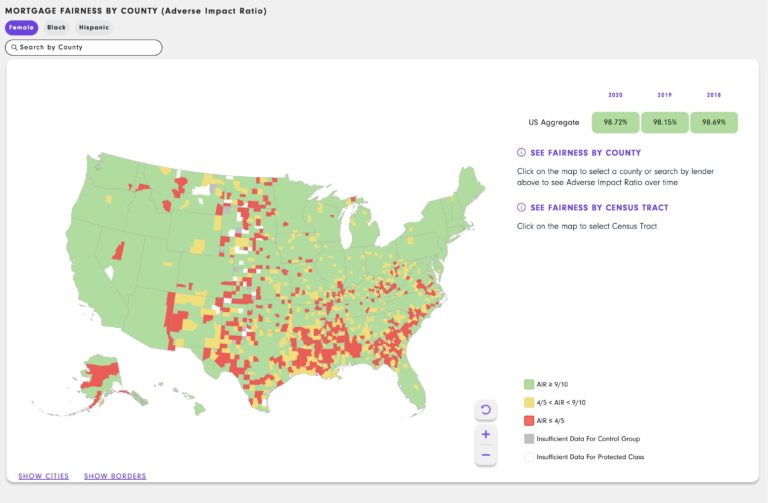

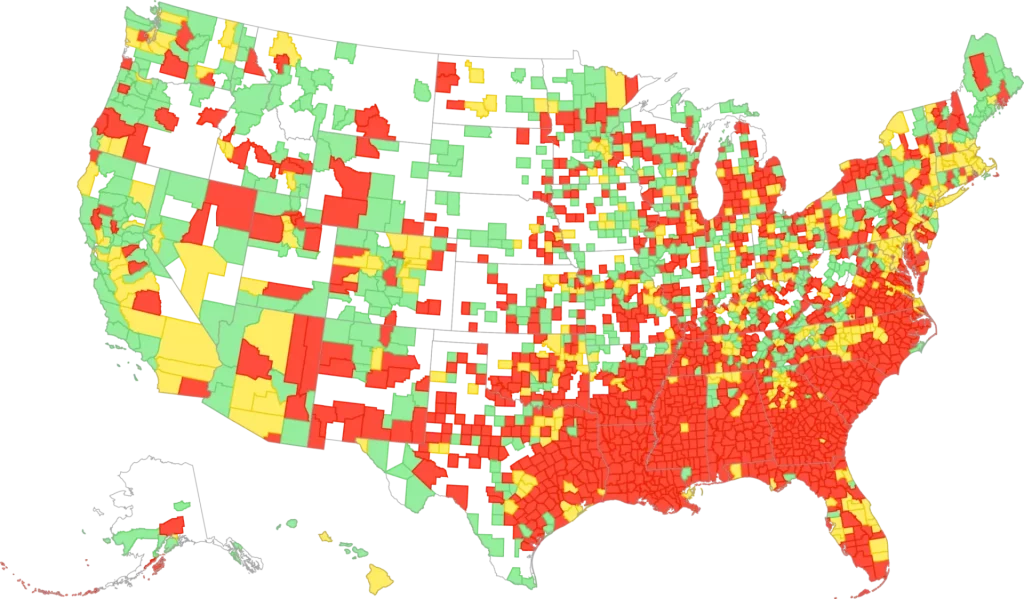

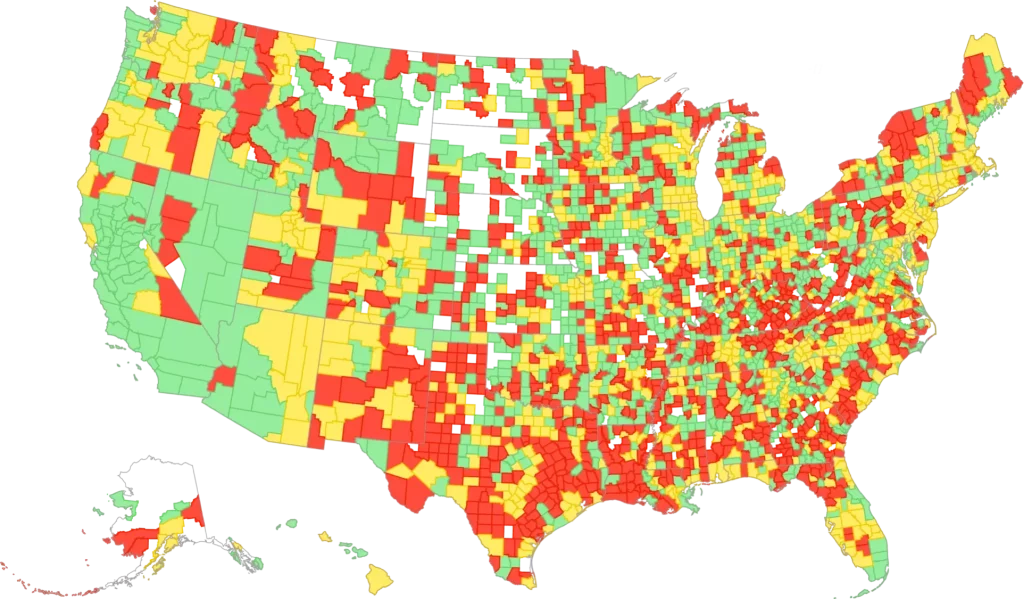

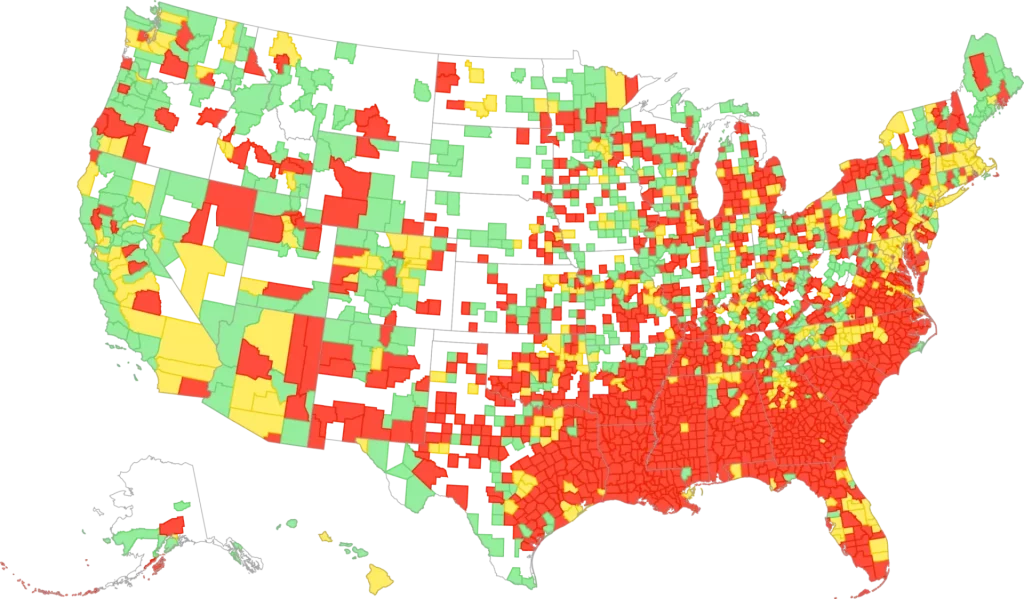

Nationally, Black homebuyers were approved at 78% the rate of White homebuyers.

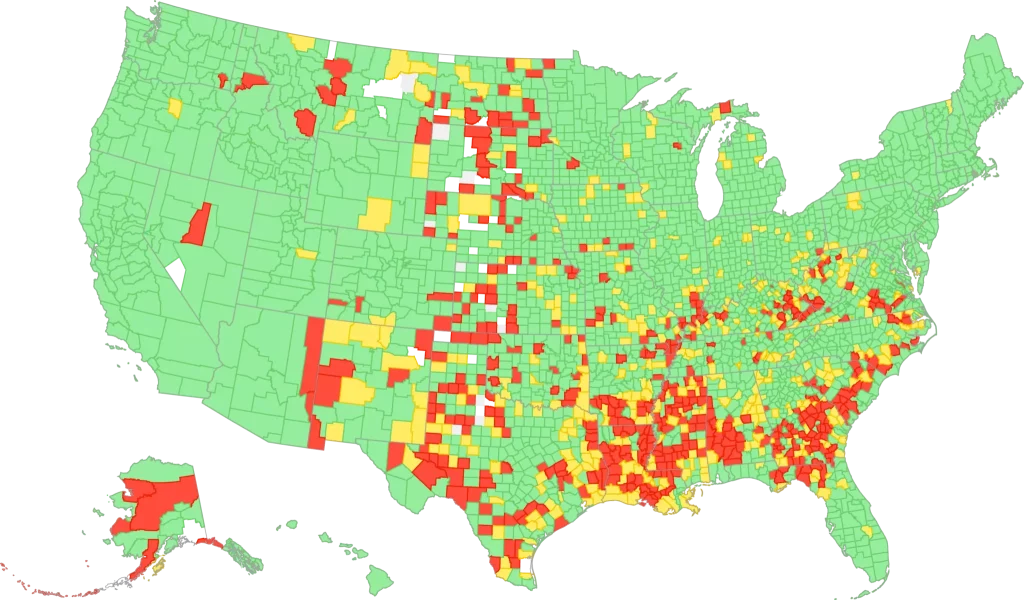

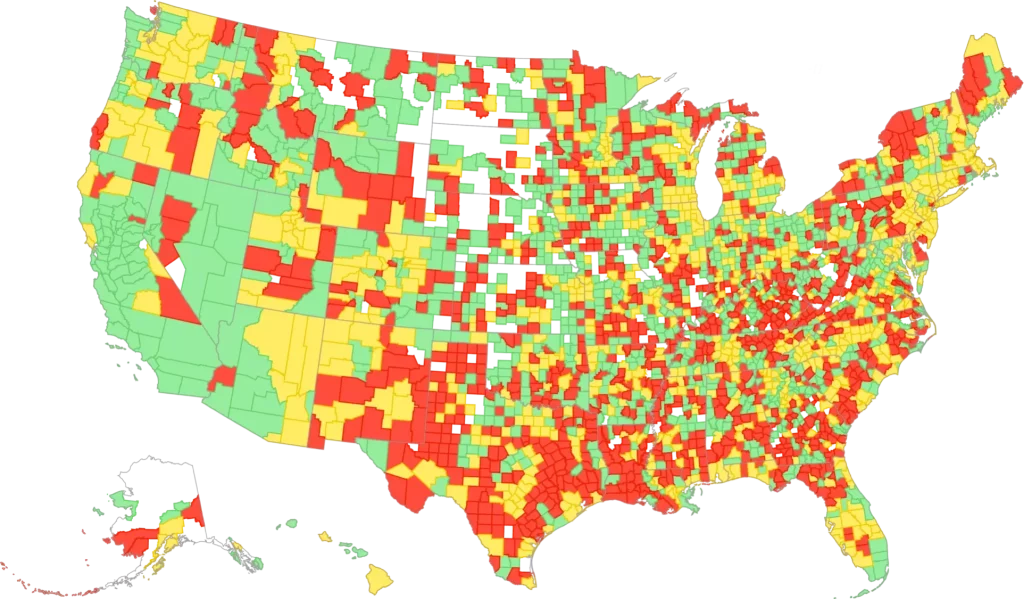

Nationally, Hispanic homebuyers were approved at 87% the rate of White homebuyers.

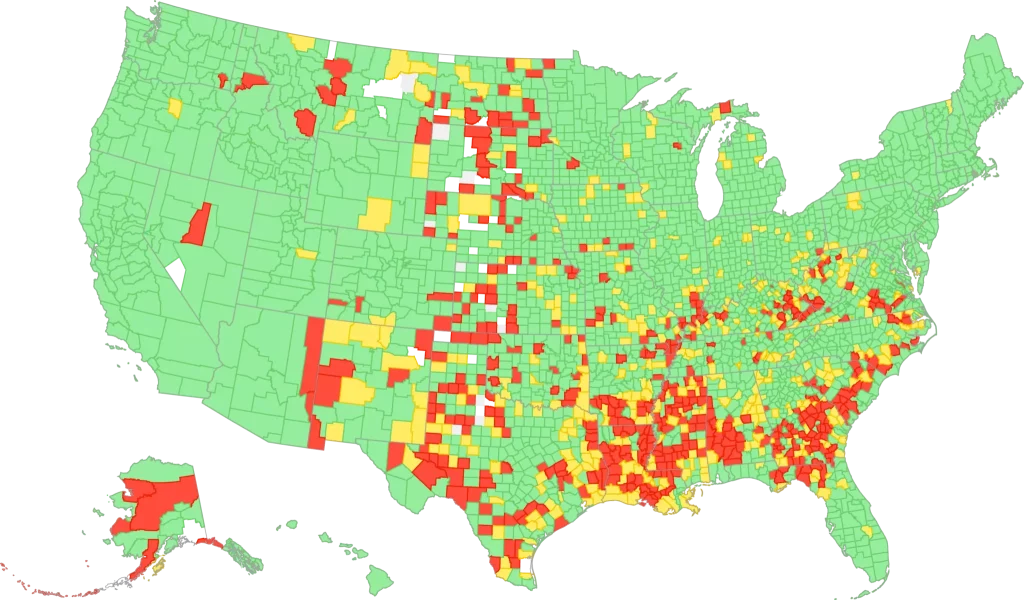

Nationally, Female homebuyers were approved at 98% the rate of White homebuyers.

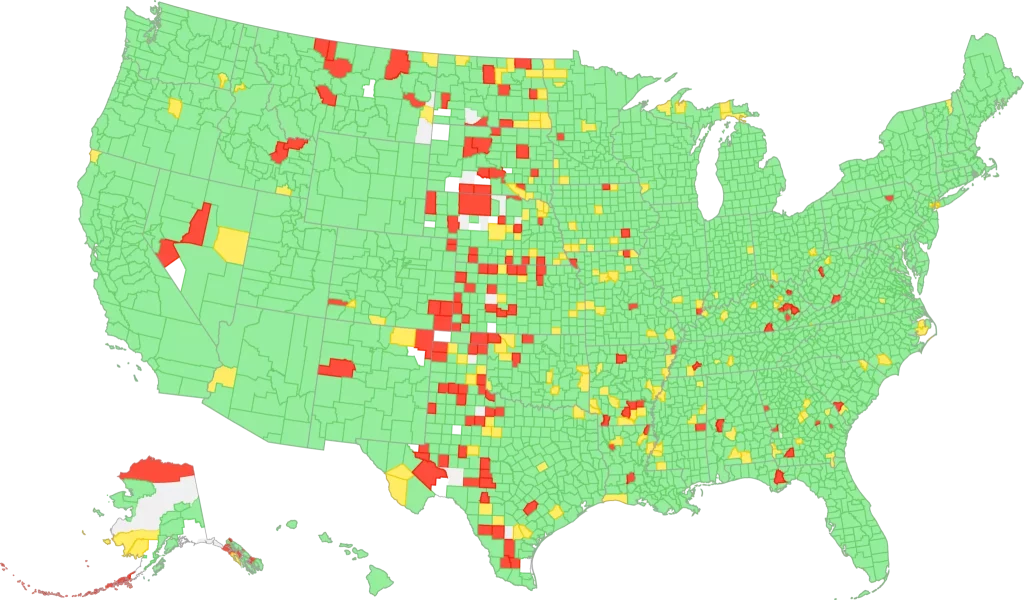

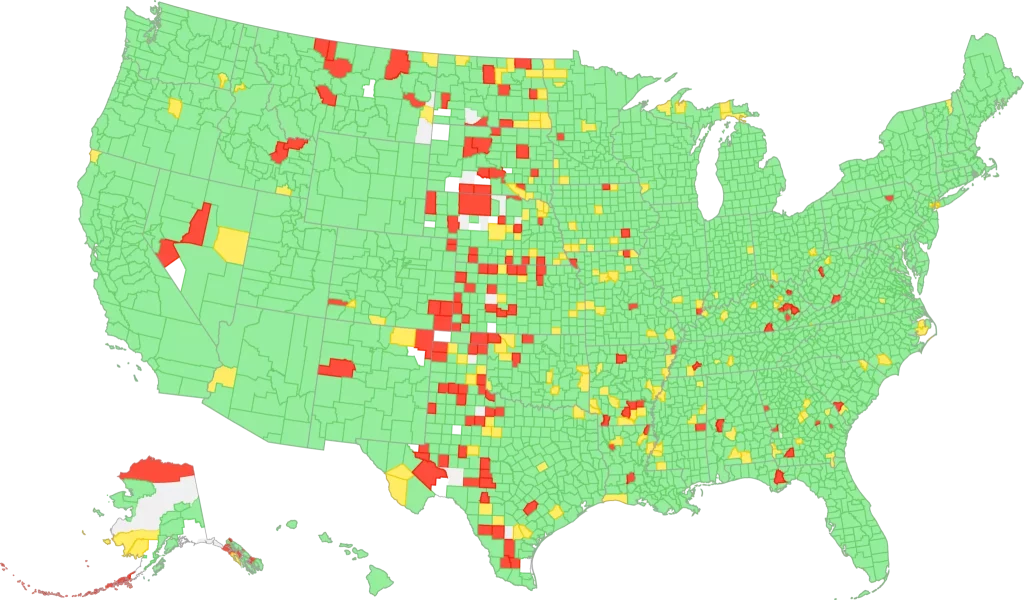

Nationally, Baby Boomers had a slightly lower approval rate relative to Gen X homebuyers.

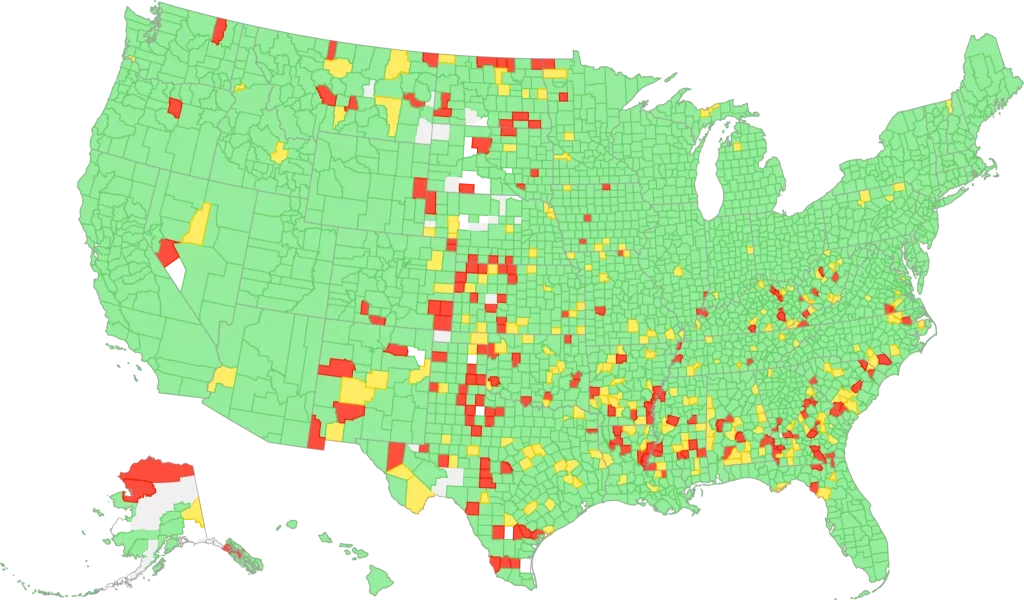

Nationally, Millennial homebuyers had the same approval rate as Gen X homebuyers.

Nationally, Black homebuyers were approved at 78% the rate of White homebuyers.

Nationally, Hispanic homebuyers were approved at 87% the rate of White homebuyers.

Nationally, Female homebuyers were approved at 98% the rate of White homebuyers.

Nationally, Baby Boomers had a slightly lower approval rate relative to Gen X homebuyers.

Nationally, Millennial homebuyers had the same approval rate as Gen X homebuyers.