Do Debt Consolidation Loans Have to Suck?

Spoiler: No, they don’t. And I’m looking for a bank that agrees and wants to prove it.

Let me explain.

Parisa Esmaili is one of the most unsung fintech entrepreneurs you’ve probably never heard of.

Her organization, Community Financial Resources, provides the Focus Card, a payroll card issued by U.S. Bank.

You might think a payroll card doesn’t sound revolutionary, but this one is.

Unlike traditional bank accounts, payroll cards are subject to somewhat different KYC requirements since the Bank issuing the card can rely on the identity verification performed by the employer.

What sets Community Financial Resources’ card apart is that it’s portable—you can keep using it even after your source of funds changes. This means Focus Card can serve as a gateway to banking for those who might not qualify for traditional deposit accounts.

In fact, the innovative relationship between Community Financial Resources and U.S. Bank has significantly reduced the number of unbanked individuals in America over the past decade.

Now, Parisa has an even bolder idea: A debt consolidation loan that doesn’t suck.

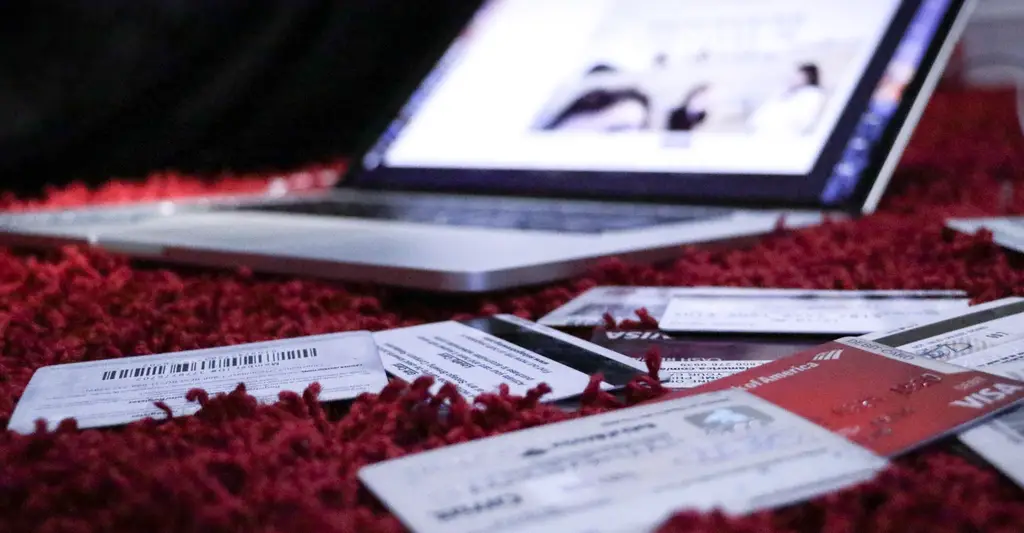

Debt consolidation loans are notorious for high fees, opaque terms, and often trapping borrowers in a cycle of debt.

But Parisa, supported by Prosperity Now, conducted a national field scan of over 100 debt consolidation products.

They found that fair, safe, and affordable debt consolidation products can be created. When structured well, these tools can help consumers repair or rebuild their credit profiles.

The best of these products are designed specifically for low-income and low-wealth consumers. Parisa has created a turnkey debt management and resolution toolkit to make these products available nationally through large-scale providers or by replicating the underwriting structure and standards across multiple institutions.

Even better? Parisa has built a financial model that shows this product can be profitable for lenders.

She’s now looking for a bank to be a design partner and finance a pilot.

So, Bankers, who’s ready to make debt consolidation loans that are good for borrowers and the bottom line?

If you’re intrigued (and you should be), please contact me about connecting with Parisa.