Americans are struggling to pay off their credit card debt.

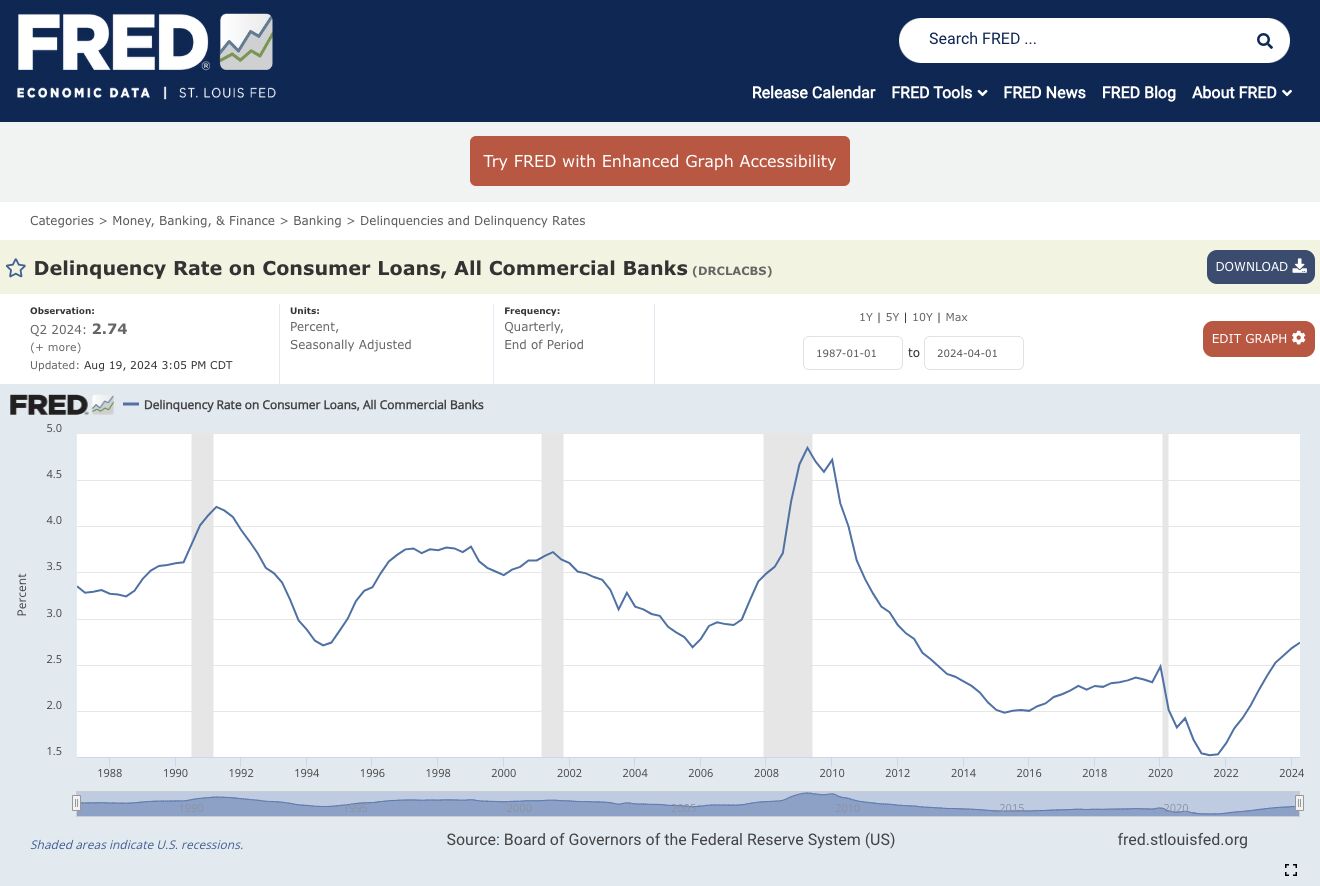

Credit card delinquencies are at levels not seen in over a decade and up 2.3x from COVID lows.

For the poorest 10% of ZIP codes, the credit card delinquency rate rose from 14.9% in Q3 2022 to 21% in Q1 2024, a 41% increase.

Even in the richest 10% of ZIP codes, the delinquency rate climbed from 4.8% in Q2 2022 to 7.4% in Q1 2024, a 54% increase.

Predictably, lenders are tightening underwriting criteria to manage heightened credit risk.

But tightening approval standards can have an unintended consequence: exacerbating underwriting disparities for protected groups – creating regulatory and reputational risk.

FairPlay offers two solutions that help lenders mitigate fair lending risks even as underwriting criteria shift:

▶ Fair-by-Threshold: Set underwriting thresholds that balance credit risk and fairness by analyzing protected group outcomes at every score cutoff;

▶Fairness Monitoring: Deploy automated surveillance that tracks fairness metrics as underwriting and policy changes are rolled out.

That’s the FairPlay way – intelligent lending that works for everyone.

Fair Lending Analysis

Identify and overcome tradeoffs between performance and disparity.