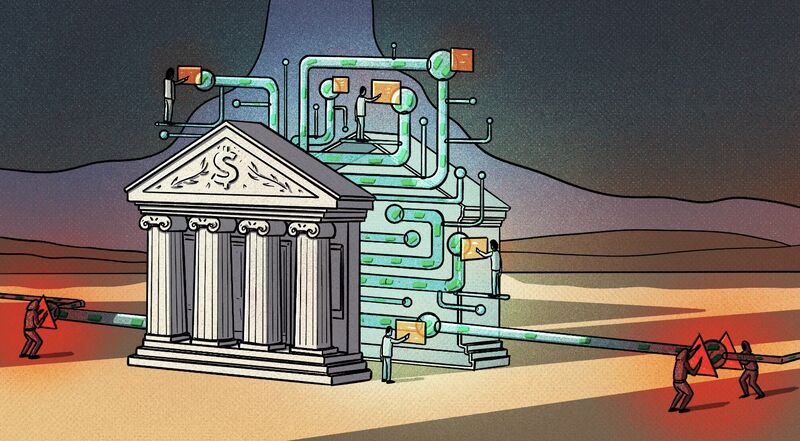

The Consumer Financial Protection Bureau just conducted its first-ever examinations of AI underwriting in credit cards and auto lending. These examinations focused on the following questions:

- Is the data your AI uses to make decisions fair?

- Is there a fairer variant of your AI?

- Can you explain your AI?

- Do you have processes and policies in place to manage AI risks?

- Does your algorithm miss opportunities or do unnecessary harm?

The CFPB exam questions point to an emerging consensus: identifying and correcting blindspots in AI algorithms is fundamentally about model quality.

This view is increasingly reflected in state actions — from Colorado’s recent AI law to proposals in the California legislature that require algorithmic accountability — and in private litigation where plaintiffs are increasingly challenging AI systems that fail basic quality standards.

AI oversight isn’t coming, it’s here and it’s becoming standard practice.

For more details, see the CFPB’s supervisory highlights on advanced technologies: https://lnkd.in/g_CPWCMr