Skip to main content

Skip to footer

Exploring AI in Telecom Credit at TRMA Kansas City!

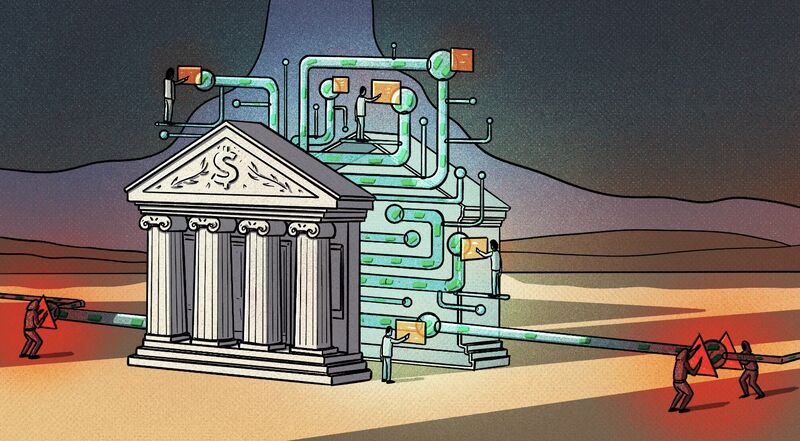

Bank Supervision Failure: Focus Shift Needed Immediately

Exploring AI’s Role in Building Fair and Inclusive Tech

AI Hiring Fail: When Overfitting Leads to Bias

Key AI Insights from CBA Live: Fairness, Compliance, and Generative AI

Essential Reading for Credit Risk Professionals: Frank Tian’s Unsecured Lending Risk Management

“Should Mortgage Originators Continue Submitting HMDA Data Despite CFPB Shutdown?”

Fair Lending Laws Remain Strong Despite CFPB Shutdown: Why Lenders Can’t Afford to Neglect Compliance

Banking Regulation in Trump’s Second Term: Weeks That Feel Like Decades

CFPB Shutdown But Fair Lending Compliance Still Matters

The 400-Year Quest to Mathematize Fairness

AI Underwriting in Financial Services: CFPB’s New Focus on Fairness and Accountability

Finding Home in LA: Supporting Our Community Through Wildfire Recovery

Treasury’s New Roadmap to Financial Inclusion: 5 Ways to Break Down Banking Barriers

Clasp Partners with FairPlay AI to Drive Equity in Education and Workforce Development

Contact us today to see how increasing your fairness can increase your bottom line.